Tesla shares (NASDAQ:TSLA) started showing some recovery on Monday, trading up 4.70% at $275.61 per share during the opening bell. The company’s apparent recovery comes amidst news of Wall Street’s optimism on Tesla stock, despite the noise presently surrounding the company.

In a recent note to clients, Baird analyst Ben Kallo stated that while there is a lot of drama over Tesla today, the company is still worth investing in. The analyst also noted that he was recently given a tour of the Fremont factory, and he came away “incrementally positive” about Tesla. Kallo outlined his observations from the tour in a note published on Monday titled Tesla, Inc.: Buy Even with Drama in LBC.

Kallo took particular notice of the advantages brought about by Gigafactory 1, which he believes will give Tesla a competitive advantage in the market. The analyst also gave TSLA a “Fresh Pick” rating amidst the company’s improving fundamentals, which would likely drive shares higher.

“Gigafactory 1 creates a significant barrier for competition and manufacturing capability should be a competitive advantage for TSLA over the long term. We believe TSLA’s Gigafactory enables the company to drive down costs through an industrialization of battery pack assembly and economies of scale. While negative headlines around management turnover and executive leadership could be an overhang, we are labeling TSLA a ‘Fresh Pick’ as we believe strong fundamentals should drive shares higher,” Kallo wrote.

The Baird analyst maintained a “Buy” rating and a $411 price target for Tesla, which corresponds to a 56.1% upside from Friday’s close at $263.24 per share. Kallo also noted that he is convinced that Tesla’s results for the second half of 2018 would likely beat expectations.

Adam Kobeissi, founder and editor in chief of The Kobeissi Letter, also adopted a somewhat bullish outlook on Tesla stock. Kobeissi noted that he is considering selling put options on shares in the wake of former Tesla Chief Accounting Officer David H. Morton’s departure from the company and Elon Musk’s behavior. In his newsletter, Kobeissi noted that the decline in Tesla stock’s price appears to be a “mispricing.”

“The reason I am doing so is because these recent events have had little impact on TSLA’s fundamentals but led to a $100 decline in the stock, which appears to be mispricing,” he wrote.

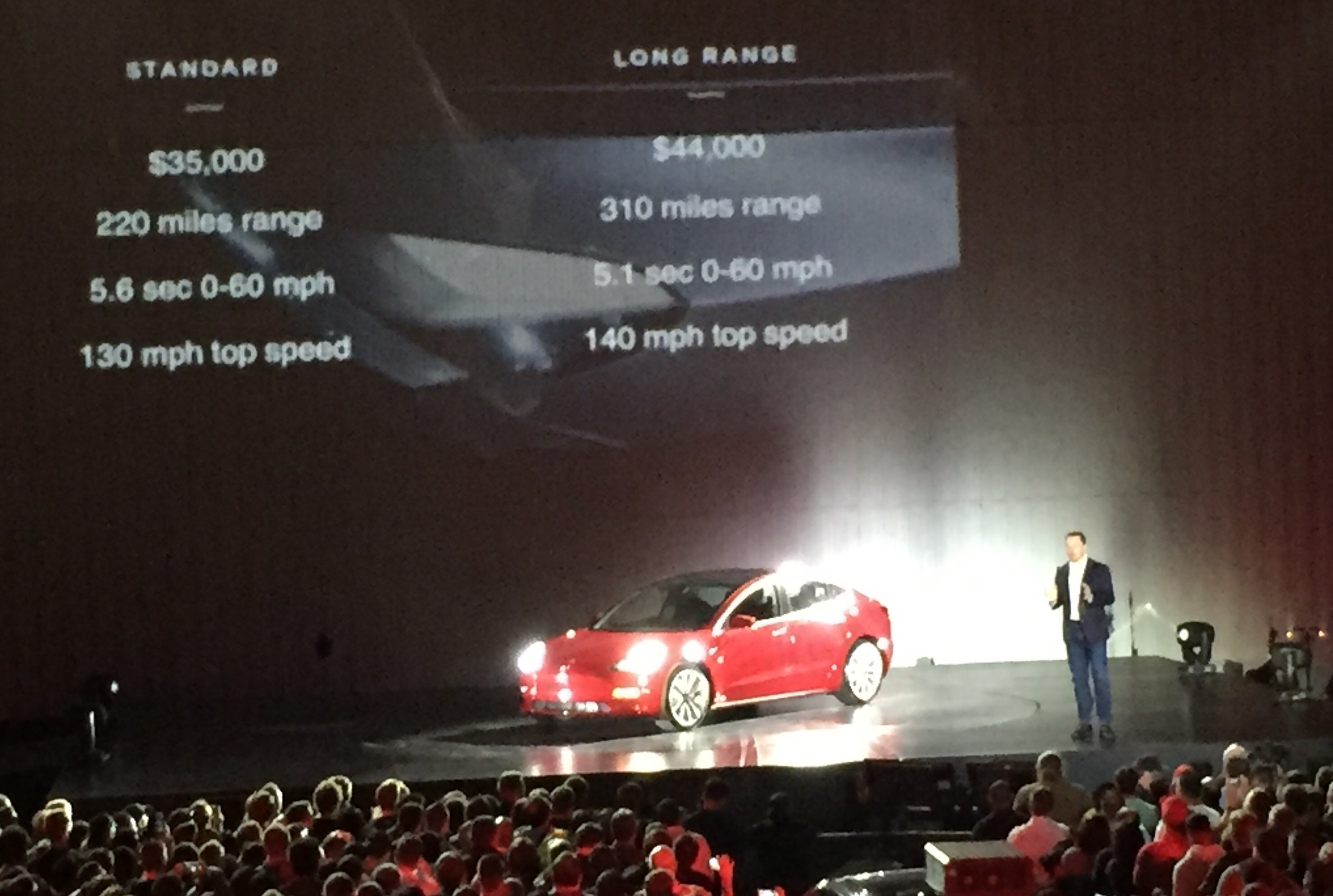

Tesla is currently aiming to produce a record number of Model 3 this third quarter, with the company targeting a production of 50,000-55,000 units of the electric car. While these targets are ambitious, a blog post written by CEO Elon Musk and posted on Tesla’s official website last Friday noted that the company is poised to have the “most amazing quarter” in its history, and it is about to build and deliver “more than twice as many cars” as it did last quarter.

As of writing, Tesla shares are up 4.47% at $275.00 per share.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

The post Tesla (TSLA) shows recovery amid analyst’s bullish outlook after Fremont factory tour appeared first on TESLARATI.com.